The danger posed by Phishing Attack, particularly SMS Email phishing in the banking and finance sector, is both ominous and widespread. The scam market thrives on exploiting unsuspecting individuals, with phishing attacks becoming increasingly sophisticated and prevalent. In my extensive 16-year tenure within the Tech industry, I’ve witnessed the alarming growth of this cyber menace, witnessing its intricate evolution. The stakes are sky-high, as falling victim to these scams can result in substantial financial losses and compromised personal information. Having encountered a similar experience recently, I was compelled to pen down this blog, aiming to assist others in comprehending the precarious terrain of cyber threats. Leveraging my extensive experience becomes imperative in unraveling the complex tactics employed by cybercriminals and strengthening our defenses against their constantly evolving strategies.

How It’s Done

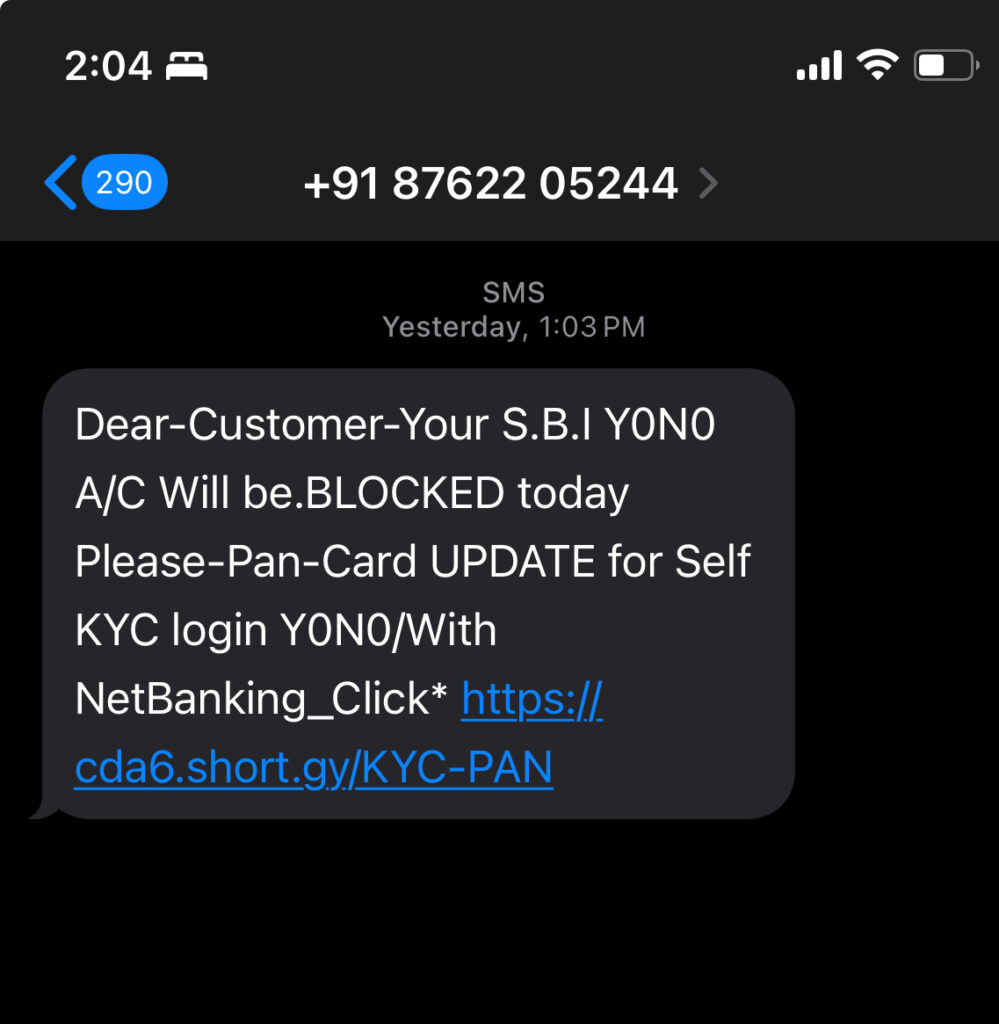

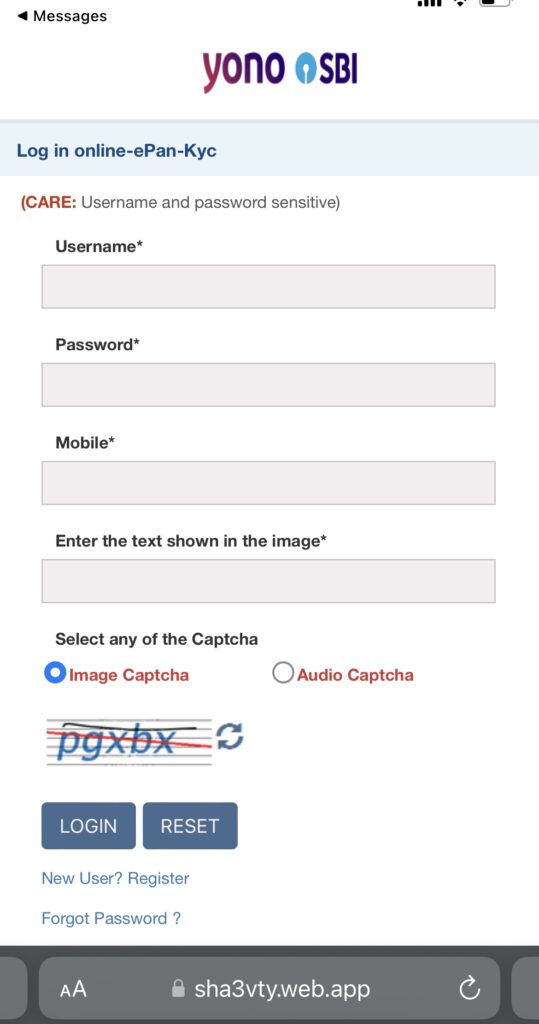

SMS Email phishing involves deceptive messages that mimic legitimate communication from trusted entities, such as banks or financial institutions. These messages often contain malicious links or prompt recipients to disclose sensitive information. Attackers leverage psychological tactics, urgency, and familiarity to deceive unsuspecting individuals.

Magnitude of Danger in Banking and Finance

The stakes are significantly higher when it comes to phishing attacks targeting banking and finance. Falling victim to such scams can result in unauthorized access to accounts, financial losses, and compromised personal information. The interconnected nature of financial systems amplifies the potential damage, making it imperative to stay vigilant.

Identifying and Safeguarding

- Verify Sender Information: Legitimate organizations often use specific domain names for communication. Verify sender details, check for subtle misspellings or unusual characters.

- Be Skeptical of Urgency: Phishing messages often create a sense of urgency to prompt quick action. Pause and verify before responding.

- Avoid Clicking Suspicious Links: Hover over links to preview the URL. If it seems suspicious, refrain from clicking. Legitimate organizations rarely ask for sensitive information via email or SMS.

- Check for Personalization: Authentic communications usually include personal details. Generic messages may indicate phishing attempts.

- Use Security Software: Employ robust antivirus and anti-phishing software to add an extra layer of protection.

In the realm of Tech and Cybersecurity, knowledge is your greatest defense. Regularly update yourself on emerging threats, stay informed about common phishing tactics, get good guidance by knowledgeable person and educate those around you.

#AskDushyant

By arming ourselves with information, staying vigilant, and adopting secure practices, we can fortify our defenses against the ominous shadows of SMS Email phishing, ensuring a safer online experience for all.

#OnlineSecurity #Cybersecurity #Banking #Finance #SMSEmail #CyberThreats #ITIndustry #KnowledgeIsKey #DigitalSafety #CyberDefense #Phishing #CyberAwareness #FraudPrevention #DigitalThreats #CyberEducation #FinancialSafety #TechInsights #PhishingScams #ITExperience #CyberResilience #DataProtection

Leave a Reply